Numbers to Know 10/22/25: The Latest on Jobs, Housing & Mortgage Rates

This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

The government has shut down, and that means most government data publication has paused as well. The monthly CPI inflation report is delayed, and the monthly jobs report is suspended this month. So I’ll have to plan to revisit those when they resume, and in the meantime, I’ll start by checking in on the last publication out of the BLS before the shutdown: the Job Openings and Labor Turnover Survey, or JOLTS for short.

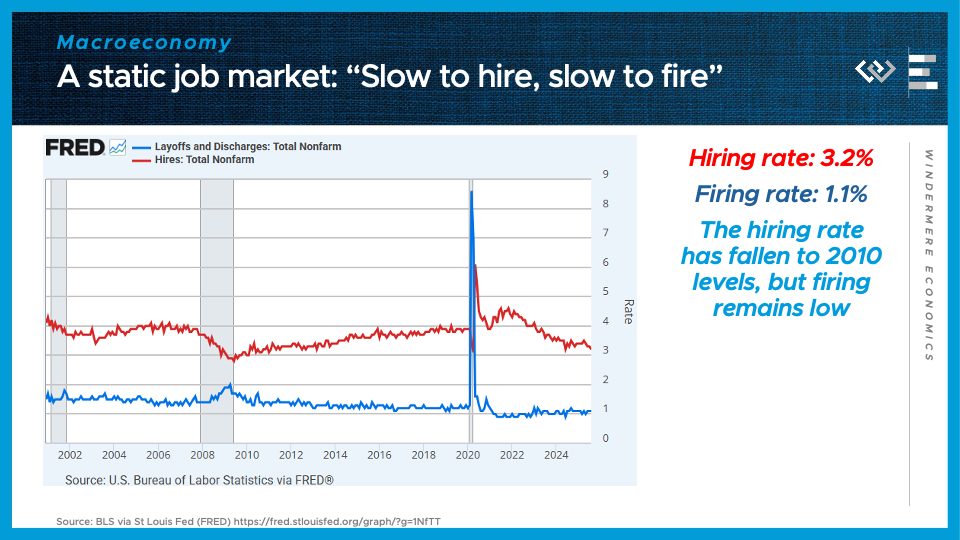

3.2%

That was the hiring rate in August, meaning the share of the workforce that just got hired. It’s around the lowest hiring rate since 2010, when the economy was just beginning to dust itself off and climb out of the Great Recession. It’s one half of a simple summary of the economy that labor economists have been using for a couple years now: “Slow to hire, slow to fire.”

1.1%

That’s the rate of layoffs and discharges, or, broadly, the firing rate, to fit the rhyming scheme. It is not particularly high right now, even if it’s up slightly from the essentially record-low firing rate below 1% we saw briefly in 2022.

Putting it together, what “Slow to hire, slow to fire” means is that employers are essentially hunkering down, hanging on to their workers but not interested in growing those payrolls quickly. For people with jobs, this means the economy feels essentially OK – not great, but OK. But for those without a job, it’s proving unusually hard to break back into the workforce, which makes this a terrible time to be unemployed, and is gradually inflicting stress on the credit system and consumer spending. These are early signs of an economic slowdown, but not yet any indication of a recession.

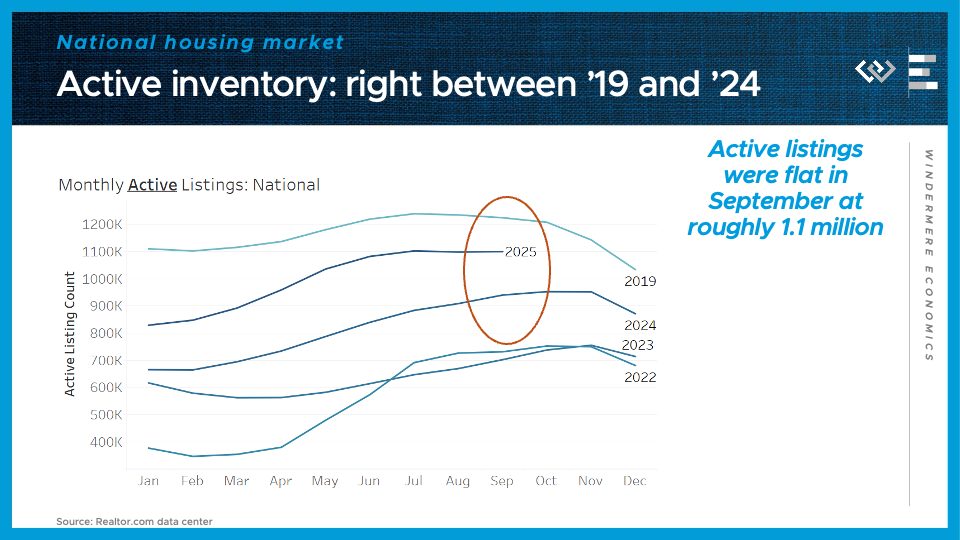

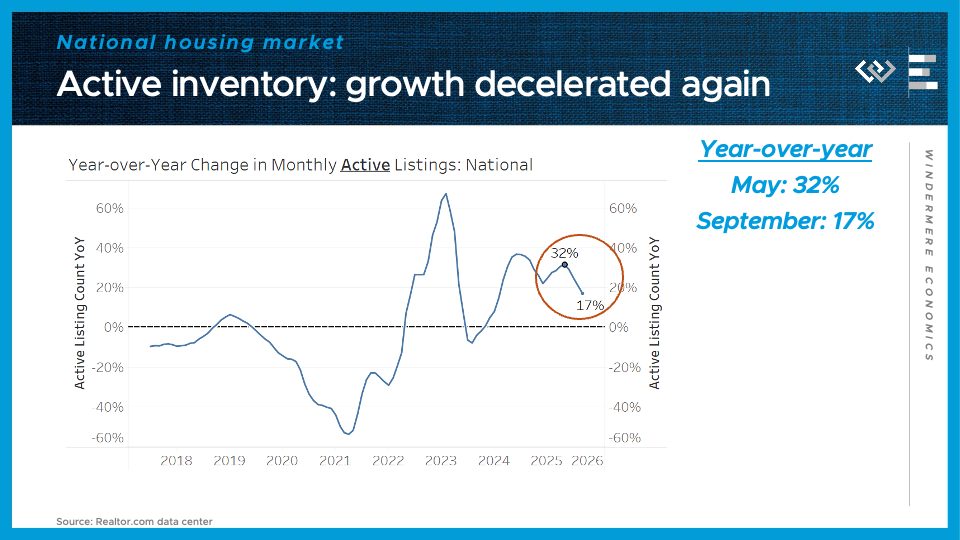

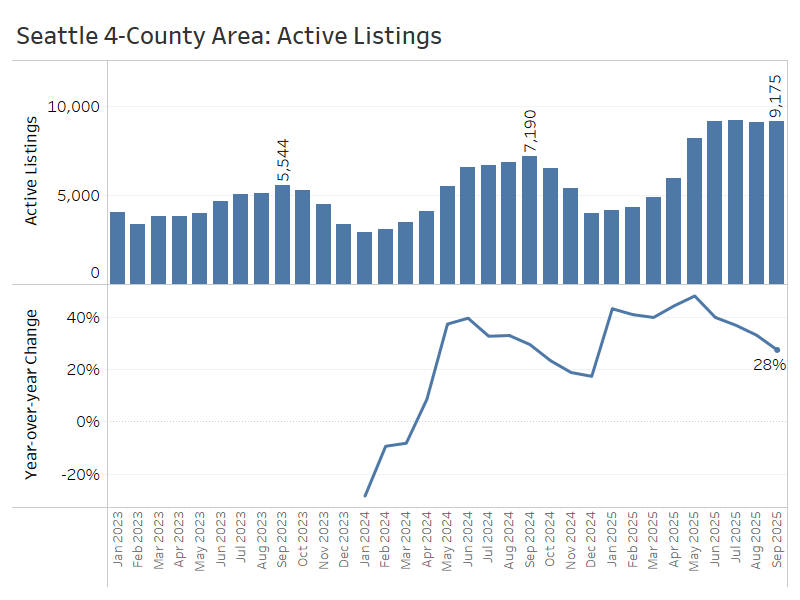

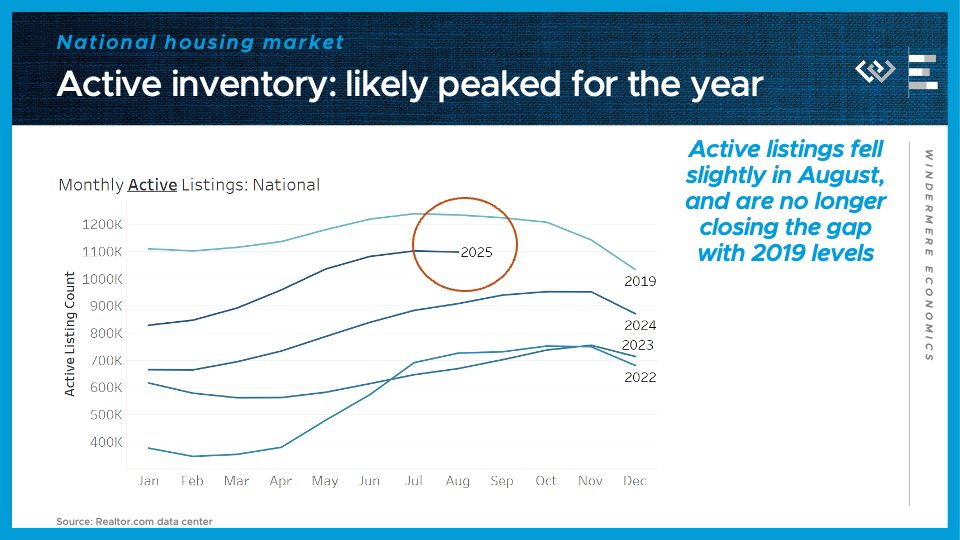

Turning to the housing market: we’ve got a familiar refrain this month. More inventory means buyers have gained more negotiating leverage, although September likely represented the high-water mark for the year, with about 1.1 million active listings for the 3rd month in a row. That’s 17% more than the same time last year.

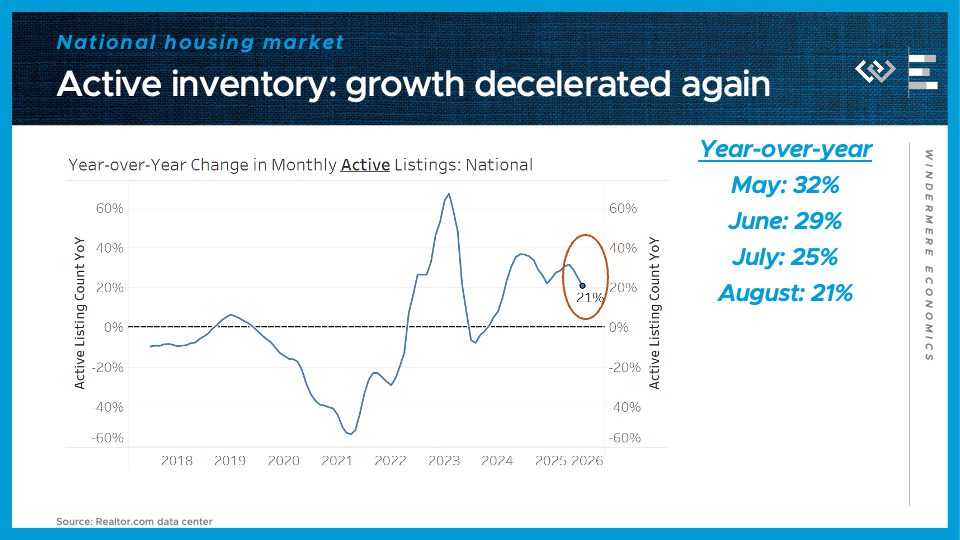

Importantly, inventory growth has passed an inflection point: for the fourth month in a row, the pace of growth of inventory has fallen yet again. Growth has now been roughly cut in half, from the 32% annual growth seen in May. That means inventory is not on a runaway growth track toward a glut that would push prices down. Rather, the market is re-equilibrating, as some sellers steer clear of a buyers’ market, or de-list after not getting a satisfactory offer. For buyers, it means conditions have moved in their favor but they shouldn’t count on that trend intensifying much further.

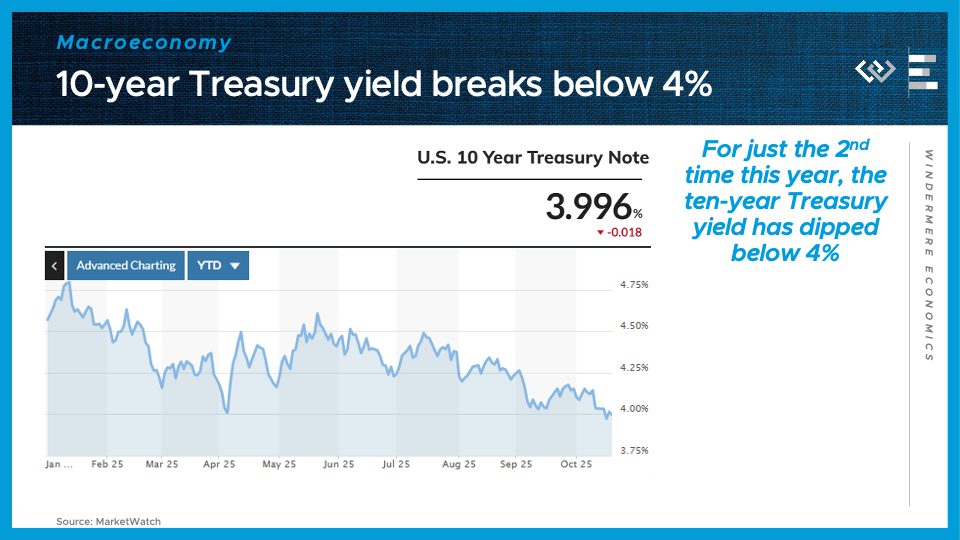

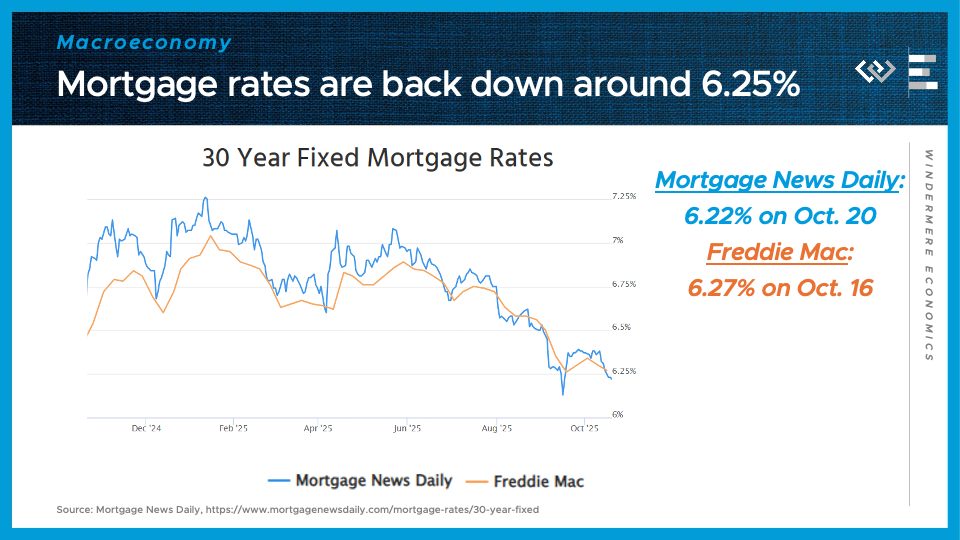

Another helpful factor for buyers, though, is that borrowing costs have continued to fall. The ten-year treasury yield, which is a major benchmark that mortgage rates tend to track, plus about 2 points, has now dipped below 4% for the first time this year. That reflects the combination of lower expected economic growth, and the resulting lower Fed Funds Rates expected over the next few years, as the Fed reacts to try to prevent a recession.

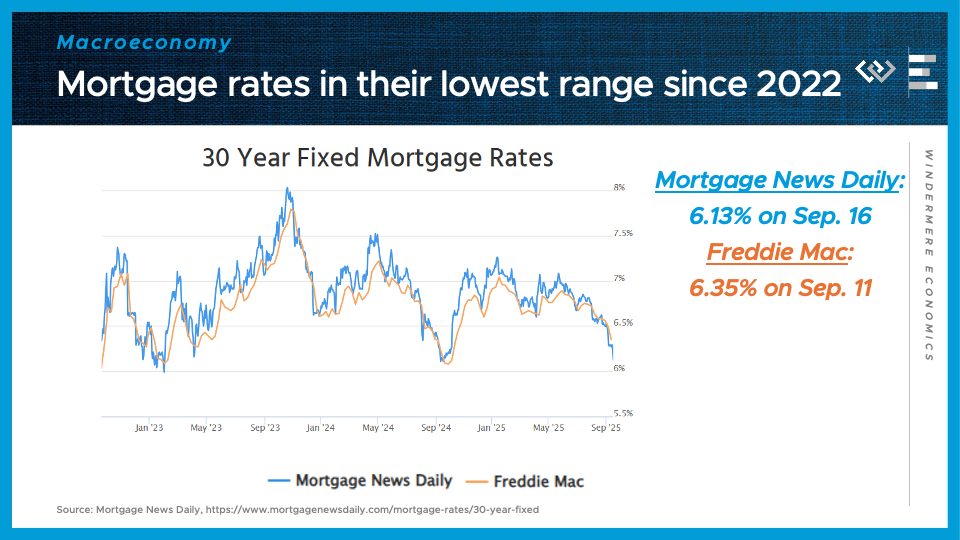

Hand in hand with those lower Treasury yields: Mortgage rates are moving back into their most favorable territory in 12 months, right around 6.25%. That represents significant savings compared to the rates of around 7% to start the year, and is partly driven by investor expectations of interest rate cuts to come. Because those expectations are already factored into the lower rates today, there’s no guarantee that mortgage rates will fall further even if and when the Fed continues cutting its overnight rate.

That is all for this month; I hope we’ll have more BLS data next month, and thanks as always for watching!

Housing Market Cools Alongside Economy in Third Quarter

This is the first in a recurring series of blog posts taking a closer look at the U.S. economy and several major regional markets in Windermere’s nine-state footprint*. Updates will be released on a quarterly basis.

*This Stephanie & Christine post specifically focuses on regions in Washington State.

See full post here

Economic Overview

After a slow spring, the U.S. housing market cooled further this summer, with price gains leveling off and sales holding steady. Existing home sales have hovered around an annualized pace of 4 million through August—nearly identical to last year’s unusually low 4.06 million. Mortgage rates dropped in the third quarter, falling from an average of 6.82% in May and June to 6.35% in September. The combination of rising inventory, softer pricing, and lower mortgage rates is making this fall a good time to buy a home.

Source: Freddie Mac via FRED.

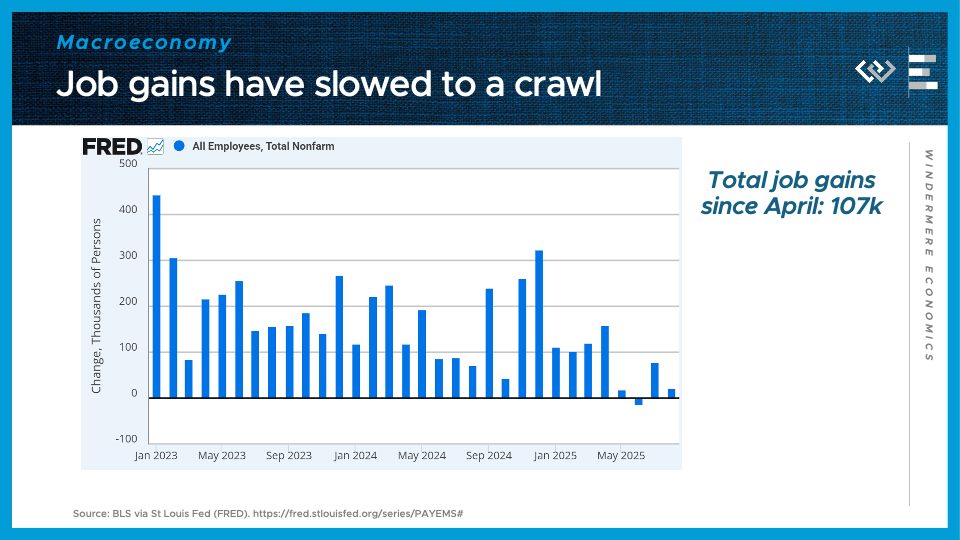

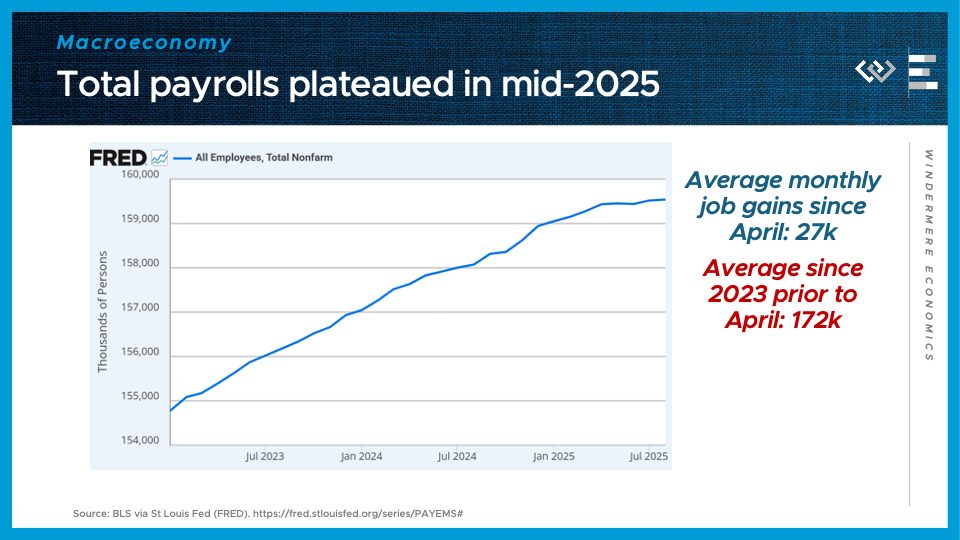

A key driver behind falling mortgage rates is the cooling U.S. economy, following a sharp slowdown in job growth over the summer. After revisions, nonfarm payrolls show little to no growth from April through August, and the next jobs reports are on hold due to the government shutdown. While slower growth poses challenges, it often brings the silver lining of lower interest rates—and this cycle appears to be following that pattern.

The following is a detailed overview of recent housing trends across three regional markets within Windermere’s footprint during the third quarter of 2025. They include Greater Seattle Area, Northwest Washington State, and Spokane County.

To see overview of Greater Portland area & Greater Sacramento Area, see full post here.

Greater Seattle Area (King, Snohomish, Pierce, and Kitsap Counties)

High inventory in the greater Seattle area has swung the balance of negotiating power in buyers’ favor across the region this year. As of the end of September, buyers could choose from nearly 9,200 active listings—8% more than the same time in 2024. Still, inventory growth has slowed throughout Q3, from a peak of 48% year-over-year growth back in May. Slower inventory growth means we are not headed for a glut of listings, which is good news for sellers.

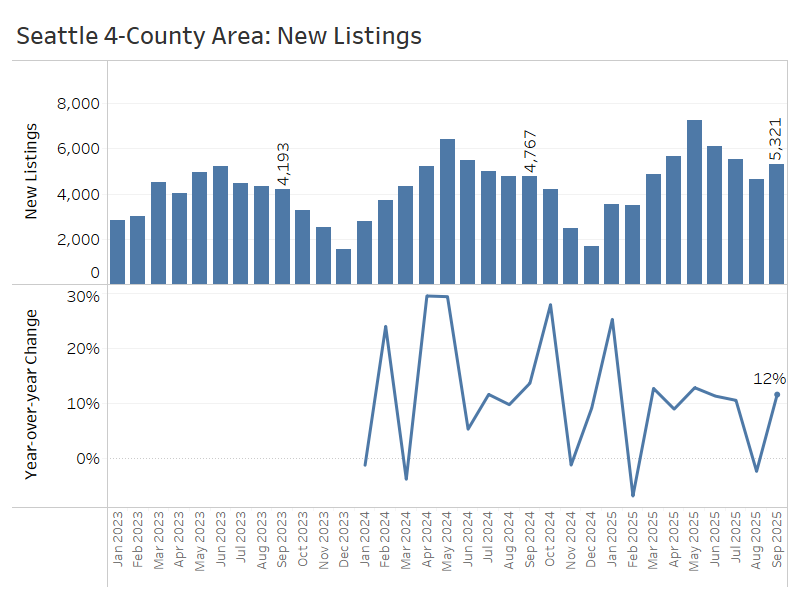

Inventory growth reflects several consecutive months of risingnew listings outpacing closed sales, which gradually replenishesthe supply of homes for sale. In September, the greater Seattle area had just over 5,300 new listings—about 12% more than last September. The entirety of Q3 reported 15,500 new listings, a 7% increase from Q3 2024.

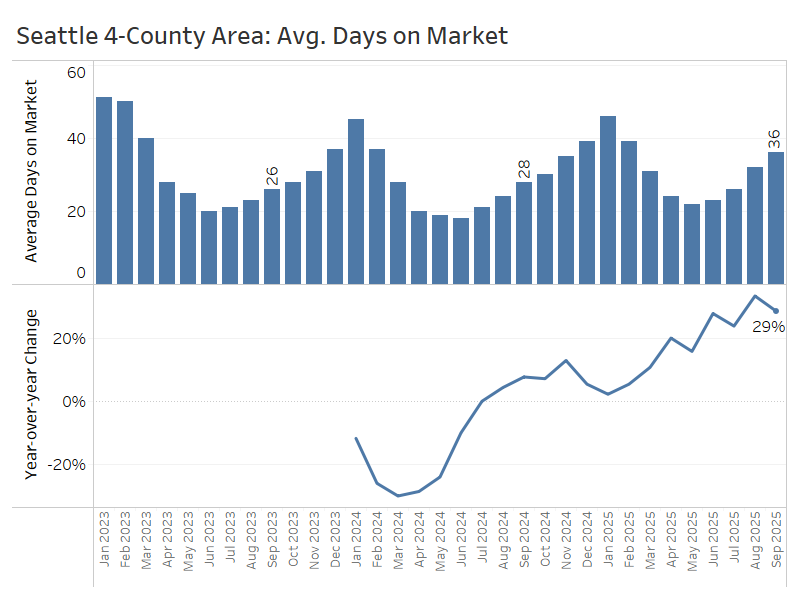

Not only do buyers have more options compared to a year ago, but they are also seeing listings linger on the market longer : an average of 36 days on market in September, up from 28 days last year. Days on market were substantially longer than last year’s levels in each month of Q3.

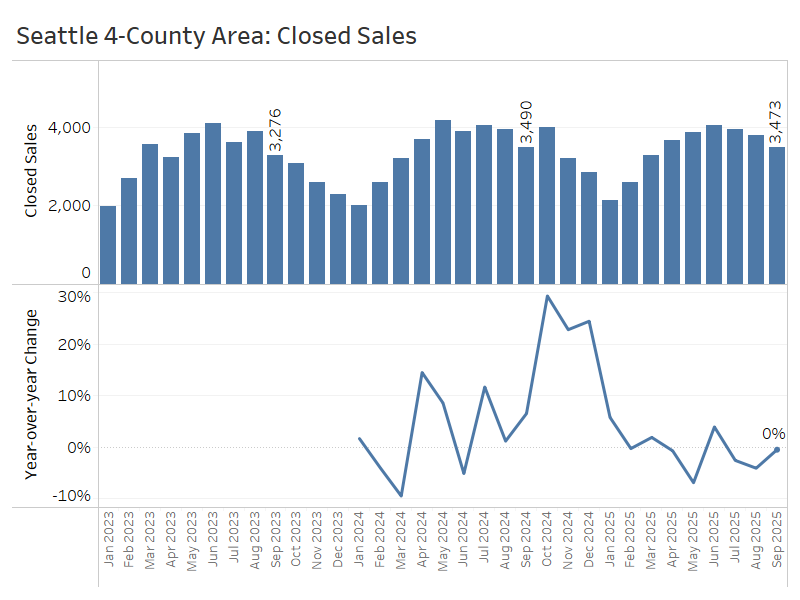

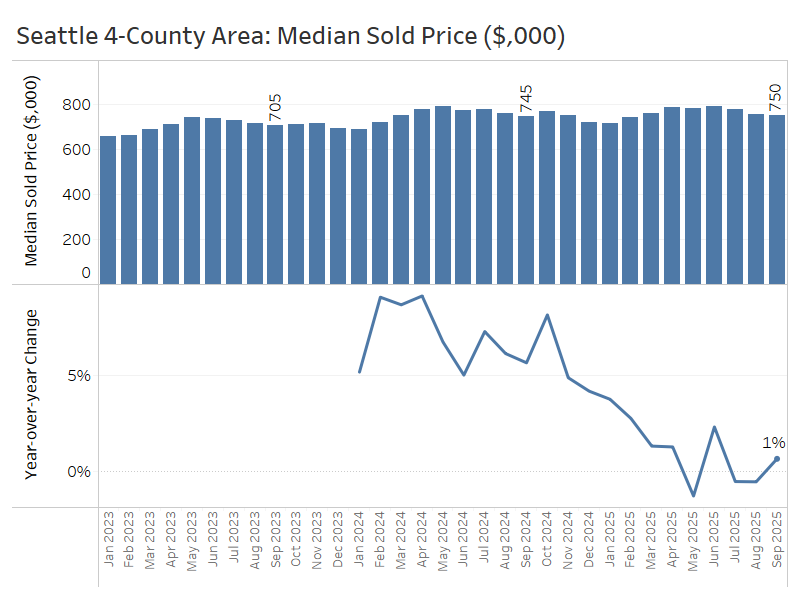

Unfortunately, the growth of inventory and new listings has not done much to generate home sales. Closed sales in Septembertotaled just under 3,500—virtually unchanged from the same period last year—following year-over-year declines of 3% in July and 4% in August.

Home prices remain flat alongside sales. September’s median price of $750,000 was up less than 1% from a year ago, after slight declines in July and August. High mortgage rates and affordability challenges are capping price growth, while rising inventory will likely put downward pressure on prices going forward. The wildcard is seller behavior—whether they’ll cut prices to sell or hold firm and wait.

The greater Seattle region is still grappling with elevated inventory, but it has clearly passed an inflection point: inventory growth decelerated over the third quarter, preventing conditions from swinging much further in buyers’ favor. As it stands, they’llstill have ample options and negotiating leverage this fall and winter.

Northwest Washington – Skagit, Whatcom, San Juan, and Island Counties

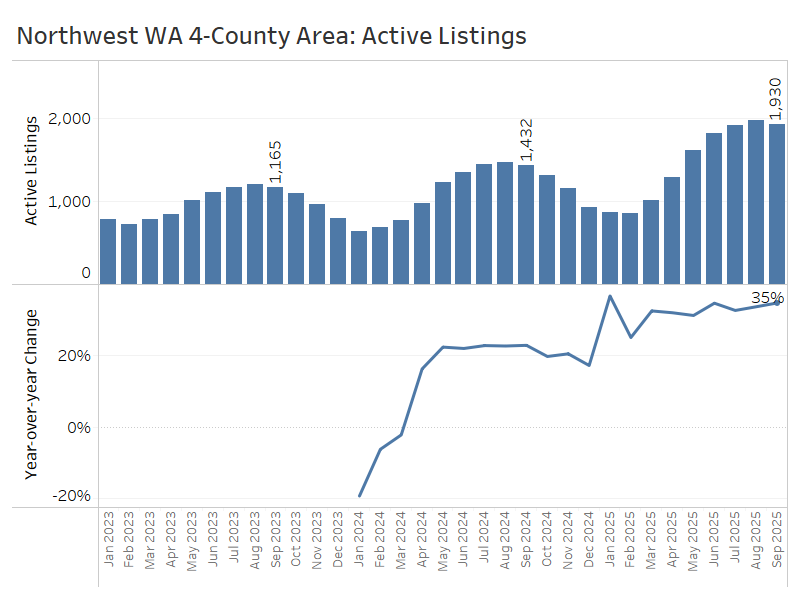

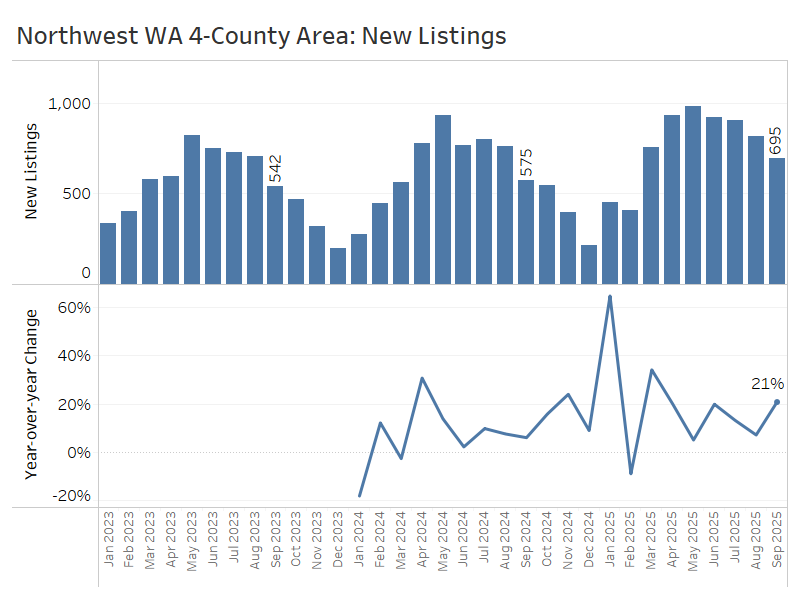

North of the greater Seattle area, the market conditions in the four northernmost counties of the Puget Sound region are experiencing a major shift in buyers’ favor.

At the end of September, there were 1,900 active listings, up 35% from a year ago. There’s no evidence of a slowdown in inventory growth here, like that of the Seattle area this quarter.

The flow of new listings has experienced healthy growth throughout most of 2025, resulting in a 21% increase compared to September of last year.

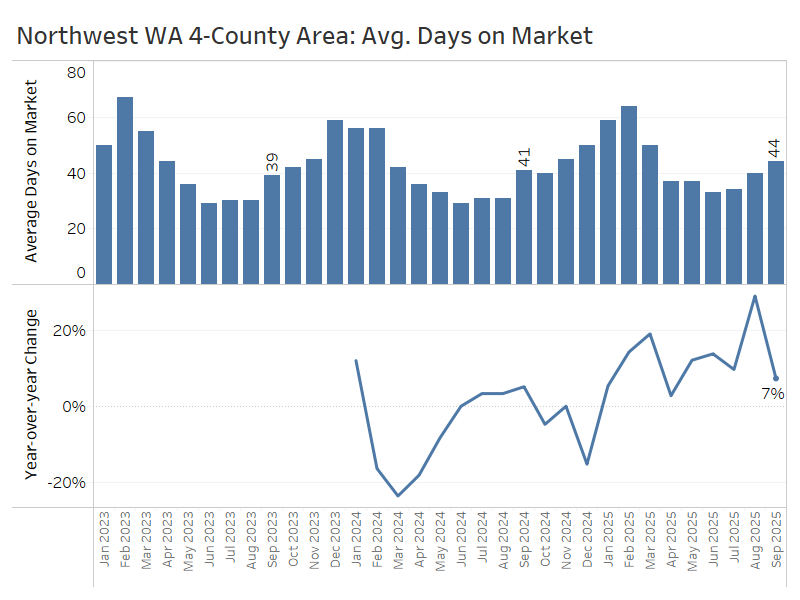

Time on market has climbed modestly but steadily all year, now up to 44 days on average in September, up from 41 days last year.

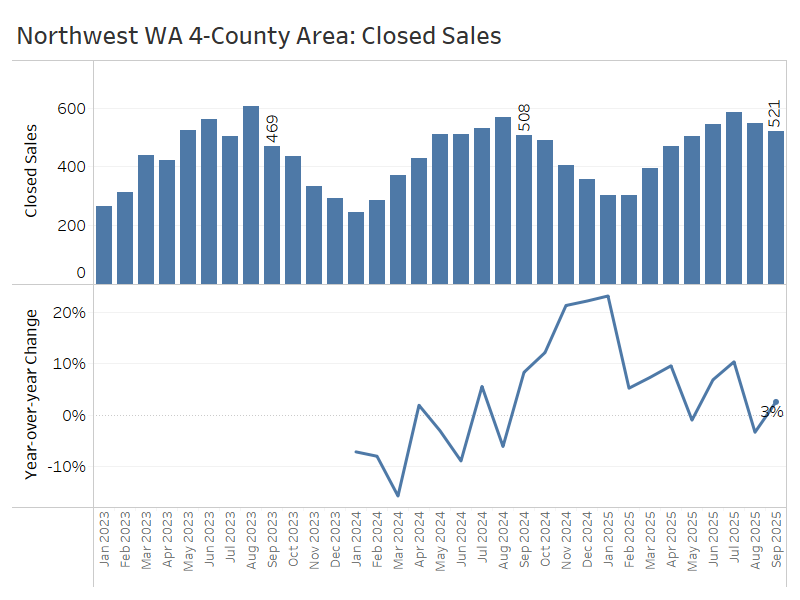

Closed sales were up 3% year over year in September, after a 3% dip in August and 10% growth in July.

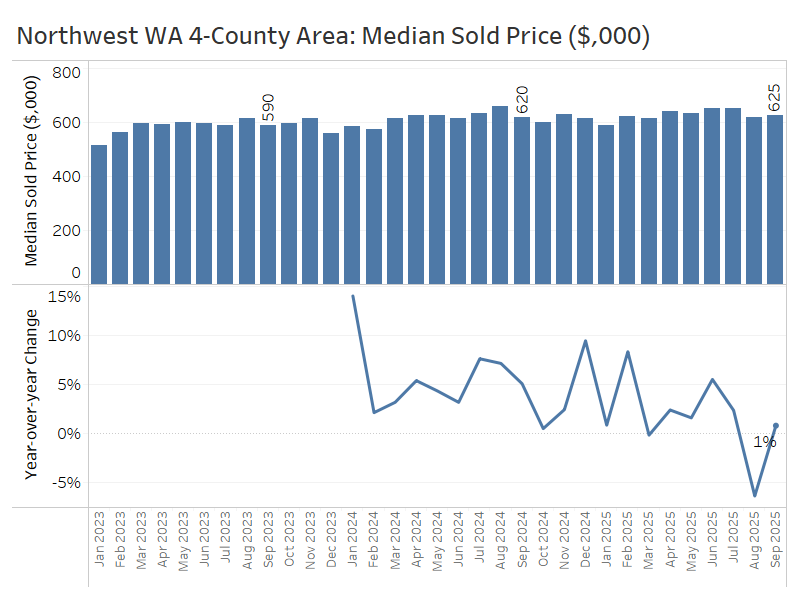

Compared to the same time last year, median home prices rose 2% in July, dipped 6% in August, and then increased 1% in September to $625,000.

Looking ahead, prices will likely cool as buyers take advantage of increased inventory and gain more negotiating power.

Spokane County, Washington

Spokane County, which anchors Eastern Washington, is experiencing many of the same market trends as Western Washington: higher inventory, softer buyer demand, and flat home prices.

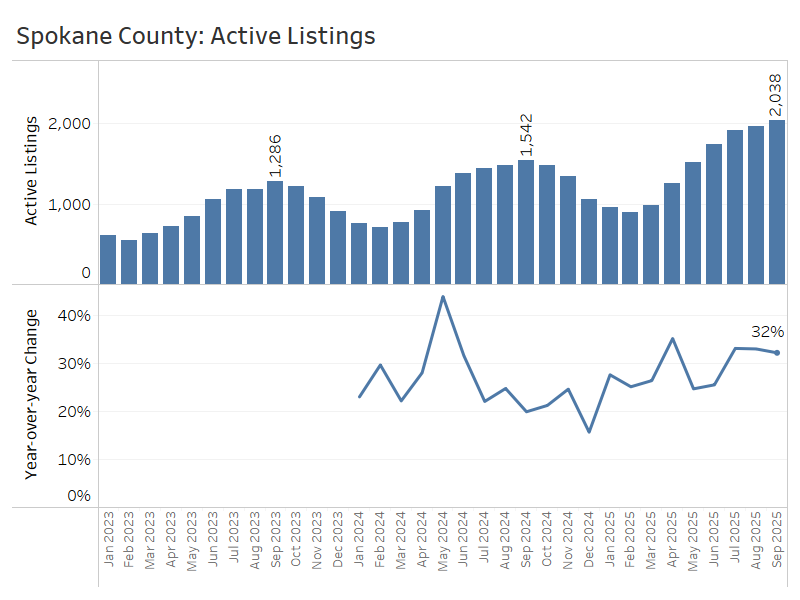

At the end of September, there were just over 2,000 active listings, up 32% from a year ago and significantly higher than two years ago, when there were fewer than 1,300 listings. The pace of inventory growth has only slightly slowed from the 33% year-over-year increases we saw in July and August.

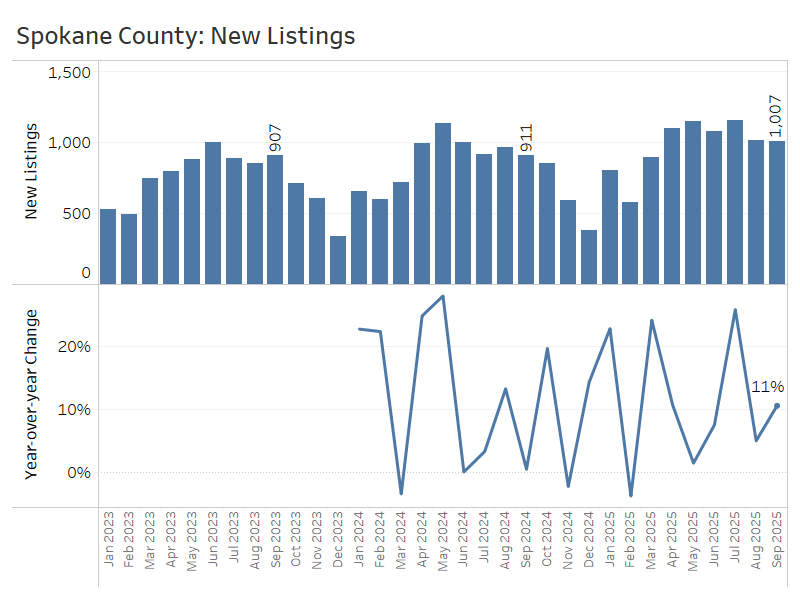

New listings climbed 11% from last September, after increasing 26% in July and 5% in August.

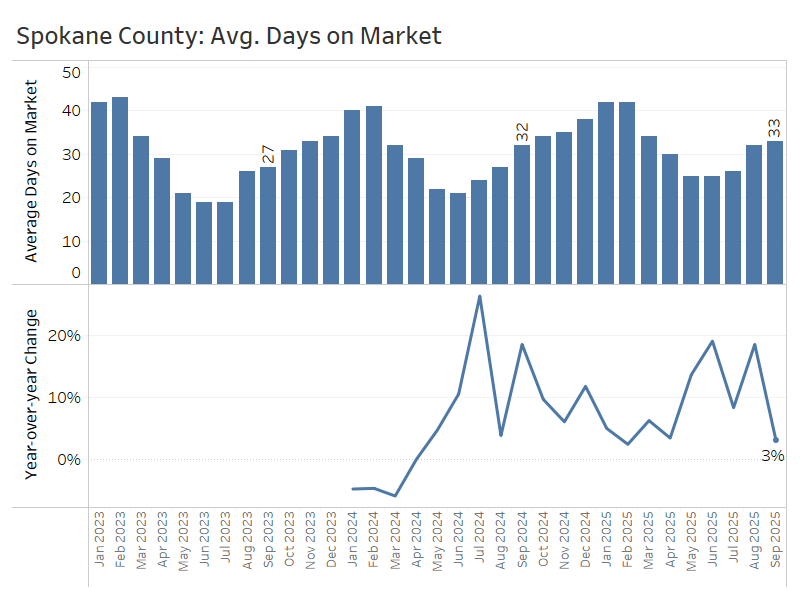

Unlike some of the other markets in this report, Spokane has seen only modest increases in the number of days it takes to sell a home, averaging 33 days this September, up from 32 during the same time last year.

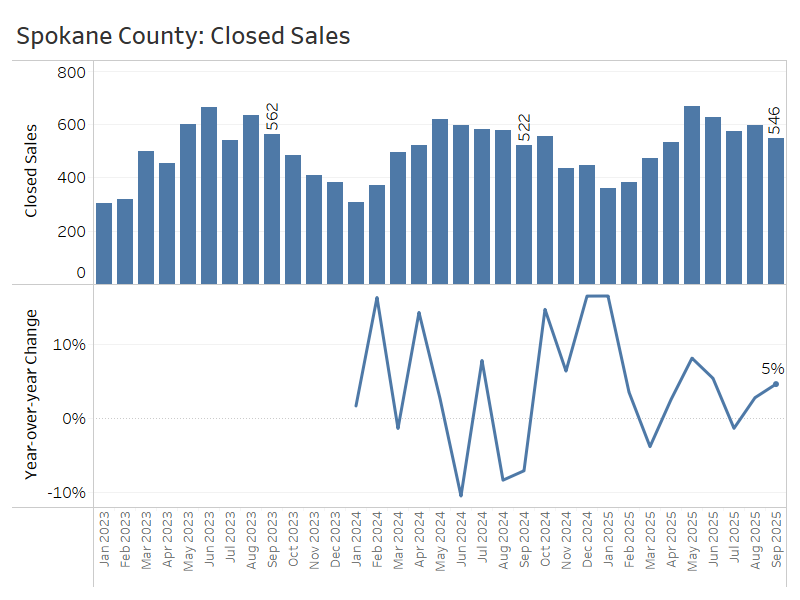

Closed sales in September were up 5% year over year, following a 3% increase in August and relatively flat sales in July.

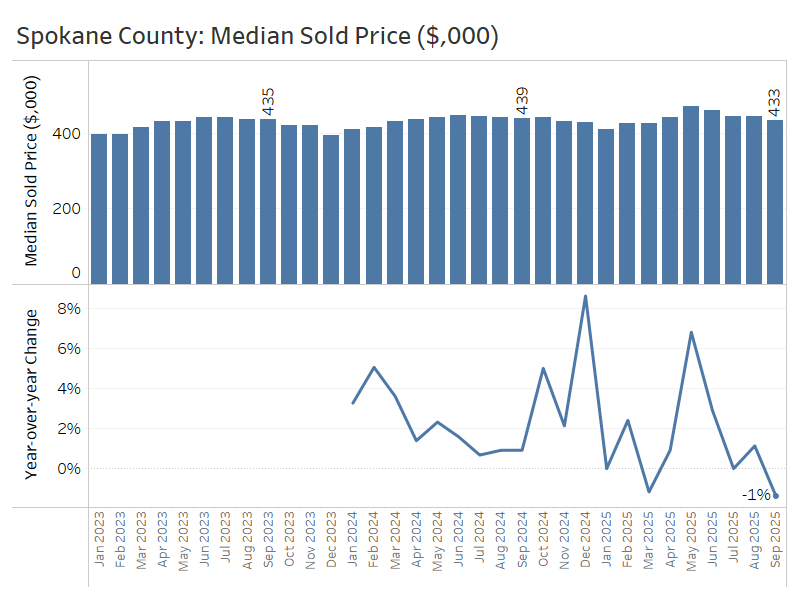

Compared to last year, median sale prices in September dipped by about 1%, from $439,000 to $433,000. Prices were relatively flat year over year in July and August.

Altogether, the more balanced market conditions in Spokane this summer began to yield more sales activity alongside flat to slightly lower prices— a healthy combination for the market right now.

Conclusion

All of the markets covered in this report have shifted into balanced or buyer-friendly territory, so it’s a good time to plan accordingly.

A consistent theme across the regions is the rise in inventory, paired with flat home sales and relatively flat prices compared to a year ago. This environment offers prospective buyers several advantages: more homes to choose from, greater leverage to negotiate, and less pressure to rush into a decision or compete in bidding wars.

For sellers, it’s important to be aware that the market has changed. Unlike the last several years, buyers now have more options, and home prices have leveled off. Success in today’s market depends on setting a realistic list price and presenting the home in its best possible light. With the right strategy, many homes are still selling quickly—and even above asking price—in every market highlighted in this report.

Sources: TrendGraphix analysis of NWMLS, RMLS, Spokane MLS, MetroList MLS, and Wasatch Front MLS data.

As Principal Economist for Windermere Real Estate, Jeff Tucker is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Jeff has over 10 years of experience as an economist at companies such as Zillow, Amazon, and AirDNA.

Issaquah is ripe with great eats, drinks, and people.

We’ve compiled a list of Issaquah’s highest rated restaurants & coffee shops, by category, just for you. So if you’re looking to expand your palette, check them out & let us know what you think!

Eats:

Breakfast/Brunch

Donuts

Sandwiches

Seafood

Asian

Steakhouse

Drinks:

Coffee

Bubble Tea

Tea

Bars

📍317 NW Gilman Blvd #31-B, Issaquah

⭐️⭐️⭐️⭐️, (912 Reviews)

(Ratings Attributed to Yelp & OpenTable)

Corner Lot, Easy Commute, Top-Rated Schools:

Need We Say More?

4514 186th Ave SE, Issaquah

4 BED | 2.5 BATH | 2,085 SQFT

OFFERED AT $1,300,000

Spacious, fully fenced corner lot along a flat cul-de-sac in a highly rated school district.

Lovely, classic two-story home with an easy commute on I-90. Just minutes to Factoria or Downtown Issaquah, and a quick jaunt or easy bike ride to community parks and beach access. Truly the perfect location!

Spacious backyard with large, railed deck, stone patio, and two separate lawn areas make the perfect space for simultaneous pets, play, and hosting. What more could you want?

Inside, find warm hardwoods and fresh carpet+paint throughout. 4 bedrooms upstairs with formal living, dining, and family rooms down means space for all.

3x mini split in addition to whole house forced air and A/C, plus a gas fireplace makes for easy comfort, year-round.

Don’t pass this one up!

Multipurpose Backyard

Fully fenced yard with separated areas make a great layout for tons of activities! Let out the dog in the side yard, have the kids play in the back, and eat dinner on the deck or patio, undisturbed.

Neighborhood Bliss

Easy access, anywhere. Get to the freeway in 2-3 minutes and pop over to Factoria or Issaquah in 10. So convenient! Not to mention the walkability. Flat neighborhood with nearby parks, trails, and beach access are a huge plus. You can have it all!

November Events 2025

Arts & Culture

Sports

Day of the Dead Events

NOV 1 - 8 | Seattle/Tacoma | Details

Seattle Restaturant Week

NOV 1 - 8 | Seattle/Eastside | Details

Shucked (Musical Comedy)

NOV 4 - 9 | Paramount Theatre | Details

Astra Lumina

NOV 6 - DEC 31 | Seattle Chinese Garden | Details

Snohomish Brewfest

NOV 8 | Thomas Family Farm | Details

Queen Anne Fall Wine Walk

NOV 8 | Details

Veterans Day Events

NOV 9 - 11 | Multiple Locations | Details

Free State & National Parks Day

NOV 11 | All State & National Parks

Quilt, Craft, & Sewing Festival

NOV 13 - 15 | Puyallup | Details

DB Cooper Conference

NOV 14 - 16 | Vancouver, WA | Details

Seattle International Auto Show

NOV 14 - 16 | Lumen Field | Details

WildLanterns

NOV 14 - JAN 18 | Woodland Park Zoo | Details

Seattle Christmas Market

NOV 20 - DEC 24 | Seattle Center | Details

Renegade Craft Fair

NOV 22 - 23 | Magnuson Park | Details

Our Annual Thanksgiving Pie Giveaway Event

NOV 25 | Our Bellevue Office | Details to Come

GeekCraft Expo / Holiday Market

NOV 28 - 30 | Magnuson Park | Details

Magic in the Market

NOV 29 | Pike Place | Details

Kraken Hockey

NOV 1 - APR 13 | Climate Pledge Arena | Details

Huskies Men's Basketball

NOV 3 - MAR 4 | Alaska Airlines Arena | Details

Newport Ski Swap

NOV 8 - 9 | Newport High School | Details

Puyallup Flat Track Motorcycle Racing

NOV 8, 22 | WA State Fair Events Center | Details

Seahawks Football

NOV 9 - DEC 18 | Lumen Field | Details

Huskies Football

NOV 15 - DEC 29 | Husky Stadium | Details

Turkey Trot(s)

NOV 16 - 27 | Multiple Locations | Details

Endurocross: Extreme Dirt Bike Racing

NOV 22 | Everett | Details

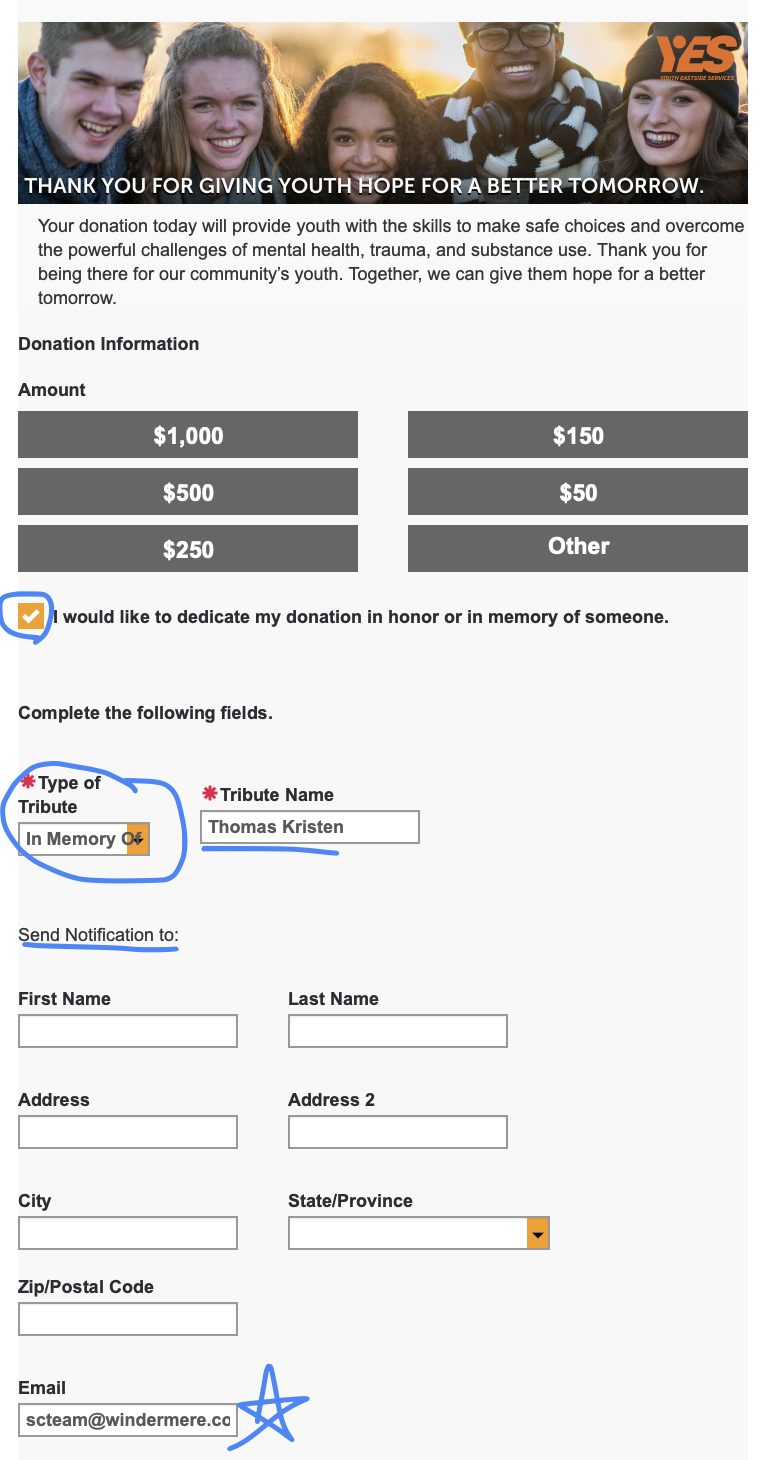

Dear Friends,

You may already know that Stephanie, her husband Erik, and their daughter Mary have recently lost their son and brother, Thomas, to suicide after a long battle with his mental health.

Stephanie will be stepping back from a front-facing role in our real estate practice for the time being. Please direct any business to SCTeam@windermere.com, or to Christine’s cell, 425-417-6892.

Thank you to everyone who has already voiced their support. It means a lot that so many people want to reach out. We ask that in lieu of social visits, texts, calls, or flowers, you may support the Kristen family through any of the following means:

- Donate in Tom’s memory to Youth Eastside Services, a Bellevue-based organization that provides services for youths suffering with mental health disorders and other life stressors. (Directions below!)

- Mail or drop off a card to our Bellevue Office, 14405 SE 36TH ST #100, and we'll make sure it gets to them

- Volunteer to provide a meal for the Kristen family through Meal Train. Contact scteam@windermere.com or reach out to Christine for the link.

We appreciate your support and grace through this difficult time. Please keep the Kristens in your thoughts and prayers, and hug your loved ones tightly.

Youth Eastside Services Donation Instructions:

Here is the link to donate:

https://wl.donorperfect.net/weblink/WebLink.aspx?name=yes&id=64

- Underneath the donation amount, click the checkbox titled “I would like to dedicate my donation in honor or in memory of someone”

- This will pop up a couple more prompts.

. - One is a dropdown box titled “Type of Tribute”,

- Select “In Memory of” as the type of tribute

. - The next one is a field called “Tribute Name”,

- Type in ‘Thomas Kristen’

. - Below is a section titled “Send Notification to:”,

- You may type ‘Stephanie Kristen’ in the Name prompt

- Leave the Address prompt empty

- In the Email prompt, type in scteam@windermere.com, so that we’ll receive a notification that you’ve donated in Tom’s name.

(It will not tell us the donation amount).

. - Then fill out the rest of the form with your own contact information and card information.

.

If you’re having trouble, please don’t hesitate to reach out.

From Starter Home to Forever Home

4285 167th Court SE, Bellevue WA

6 BED | 4 BATH | 4,380 SQFT

Nothing beats a starter home like a forever home, and we’re especially honored to have been able to find both for these clients! 🤗

A few years back, we helped them purchase their starter home in Issaquah, and now we’ve just helped them close on their forever home in Bellevue. What a pleasure!

We’re extra proud of this one, as we got it under contract in under 24 hours from the list time! These clients had been searching for a while, and they knew exactly what they were looking for. So when this home came on the market, we jumped right away!

🎉 Our clients are thrilled, and so are we! We love what we do, and it’s so rewarding to help our clients transition to the next step in their home ownership journey. Buying, selling, or just planning what’s next, we’re here to make it as easy as possible for you!

Why AI Can’t Replace Your Real Estate Agent

Technology is transforming nearly every industry, and real estate is no exception. New tools and innovations are reshaping the way we search for, buy, and sell homes. Among these advances, artificial intelligence (AI) has quickly become one of the most talked-about technologies, being used for everything from writing and research to customer service. Naturally, this raises the question of whether it could ever replace jobs that rely on human connection and expertise, like real estate.

In the sections ahead, we’ll break down what AI can and can’t do in real estate, and how agents can use it to their advantage rather than view it as competition.

What is AI?

Artificial intelligence (AI) is technology that allows machines to simulate human intelligence. In recent years, AI has grown at lightning speed and has become part of daily life, often in ways people don’t even notice. Generative AI tools like ChatGPT, Copilot, Gemini, etc., are the ones most people hear about because they can answer questions, draft text, or create images. At the same time, other forms of AI are working quietly behind the scenes on websites, apps, and services we use daily, from recommendation engines to fraud detection.

Together, these tools are changing how we interact with technology, making it faster and more efficient. But when it comes to buying or selling a home, no algorithm can replace the insight, guidance, and personal care of a trusted real estate agent.

How AI is Shaping Real Estate

AI is already influencing how buyers and sellers approach the market. From predictive pricing tools and market analysis platforms to more intelligent home search engines, AI can process large amounts of data and provide insights more quickly than any individual could manage on their own. For agents, it can automate repetitive tasks like drafting emails or creating basic listing descriptions, while chatbots help answer simple client questions around the clock. Some platforms even use AI to match buyers with properties based on preferences or past behaviors. These tools save time and make processes more productive, but they’re only part of the real estate experience.

Why Real Estate Needs a Human Touch

The Future: Agents + AI, Not Agents vs. AI

Buying or selling a home is never just about the transaction—it’s often one of the biggest financial and emotional decisions of a person’s life. And while AI may provide quick data or market insights, it can’t sit down with an individual and understand their specific needs, calm their nerves during a stressful moment, or celebrate when the keys are finally handed over.

A real estate agent listens, adapts, and advocates for their clients in ways that no algorithm can replicate, bringing empathy, intuition, and lived experience into the equation rather than just facts and figures. They know the neighborhoods, the schools, and the subtle details that make a house a home. They can recognize when a client needs reassurance, when to negotiate a little harder, and when to suggest a creative solution to keep a deal moving forward. These instincts and skill sets are built on years of human connection, which is what makes the difference between simply completing a deal and guiding someone through a life-changing experience or helping them reach their real estate goals.

Rather than replacing real estate agents, AI has the potential to make their work even more impactful. Tools like virtual tours, AI-powered staging, and digital imaging can help buyers visualize a property in new ways, while automation can create marketing materials, streamline scheduling, and analyze market trends at an increased speed. These efficiencies free up time and energy for agents to focus on what matters most: listening to clients, building trust, and guiding them through one of life’s most significant decisions.

When used thoughtfully, AI shouldn’t be viewed as a competition, but as a business companion. By blending cutting-edge technology with the irreplaceable human touch, real estate agents can continue to grow their business, deliver better service, and strengthen the personal relationships that remain at the heart of every successful transaction.

At Windermere, our agents use every tool available, but it’s their expertise and personal care that truly set them apart. Connect with an experienced Windermere agent today:

Numbers to Know 9/18/25: Why the Fed Cut Rates & What It Means for Housing

This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

The Fed has finally started cutting. The two big questions are: Why? And now what?

I’ll start with the why: the labor market has started showing signs of distress. The August jobs report delivered more bad news, continuing a streak of weak job growth since April.

The overall growth of nonfarm payrolls – the number of employed workers in the country – clearly passed a turning point this spring, as growth as slowed to a crawl.

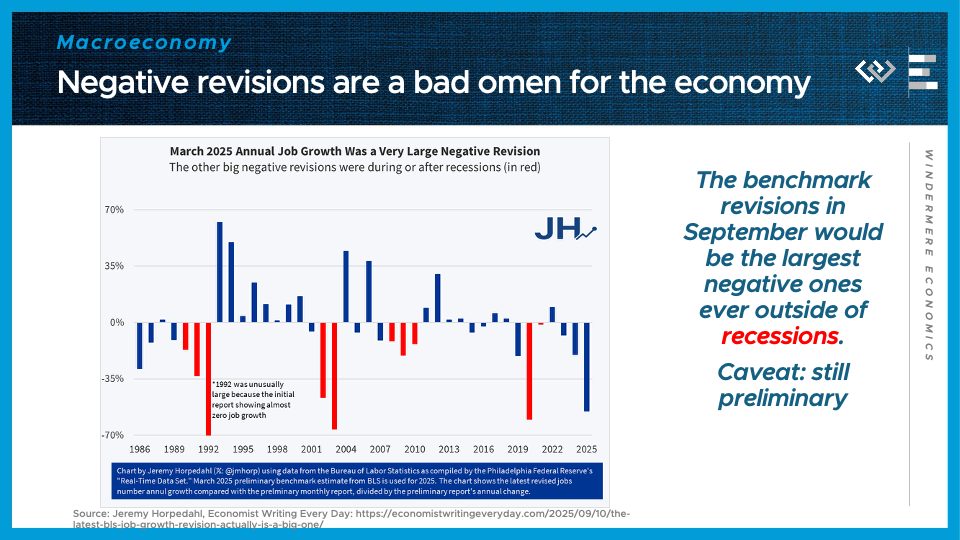

Moreover, the Quarterly Census of Employment and Wages just revised away more than HALF of the job growth previously estimated to have happened in the year ending March 2025, wiping out over 900,000 jobs originally thought to have been added in those 12 months.

Historically, as this chart by Jeremy Horpedahl highlights, big negative benchmark revisions, like the preliminary one released this month, have occurred during recessions. And big negative monthly revisions, like last month’s have been more common just before recessions.

That doesn’t mean a recession is around the corner, but it helps explain why the Fed is changing their posture to try to stop a recession before it gets going.

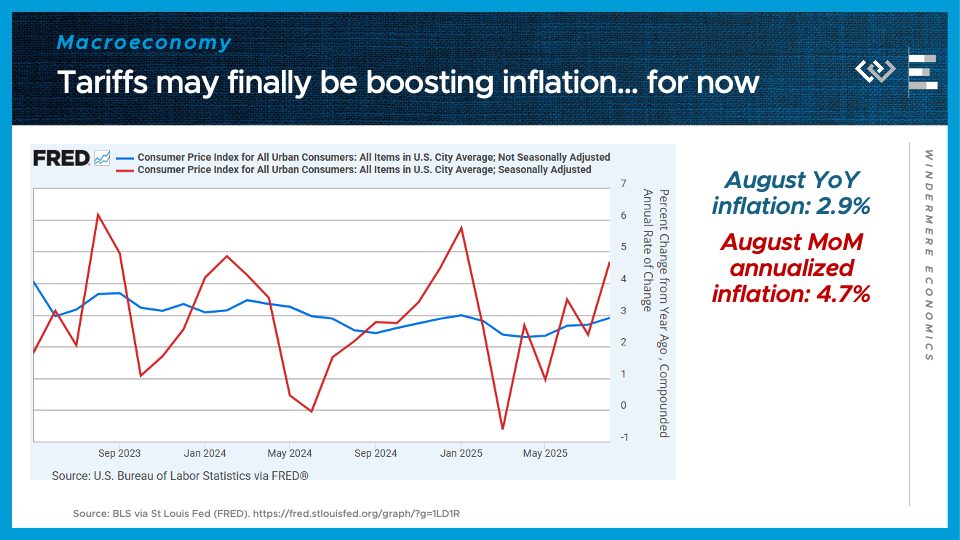

One challenge they’re facing, though, is that they have paused their fight against inflation before it was quite finished: annual inflation stopped falling this spring, and has now re-accelerated to nearly 3%; the more volatile monthly inflation rate is running at 4.7% annualized. Part of the reason the Fed is now willing to cut may be that they view some of this inflation as a transitory, one-time bump from tariffs, that they are willing to look through; but I think the biggest reason is just that the warning sirens in the labor market became too loud to ignore.

Turning to the housing market: the balance of power has swung in buyers’ favor this year, thanks to higher inventory, but it’s now clear that inventory growth passed an inflection point: for the third month in a row, the pace of growth of inventory has come down again. Now it’s down to just 21% growth from August of last year.

At the end of August, there were just under 1.1 million active listings on the market – down slightly from July, while each of the last 3 years saw inventory grow in August. This means buyers are still favored in many markets, but they can’t count on that pendulum to keep swinging further in their favor.

Especially because of the huge news for everyone in the housing market: mortgage rates have fallen to the neighborhood of 6 and an 8th percent, roughly their lowest level since 2022. Investors were anticipating this rate cut by the Fed, and if anything, the fact that the Fed was willing to press ahead with cutting rates, in spite of firmer inflation data, demonstrates their commitment to focus on helping the labor market with easier monetary policy, while setting aside inflation fighting to another day. Maybe more than anything, that change of posture by the Fed is helping to bring mortgage rates low enough that well-qualified borrowers are starting to see a 5-handle without paying any points. There’s no guarantee that the low rates will last – just look at what happened last October, so I’d advise everyone to strike while the iron’s hot. If rates do fall further this winter, well, you can always refi then.

Protect your home’s value today — and make selling easier tomorrow.

As the leaves start to fall and the temps drop, it’s the perfect time to give your home a little extra TLC. Whether you're planning to sell in a few years or stay for the long haul, regular maintenance now saves you headaches (and cash) later. Plus, a well-maintained home makes a huge difference when it comes time to list — and you already know who to call when that day comes 😉.

We’ve put together a simple, proactive Fall Home Maintenance Checklist to help you stay ahead of the game.

✅ Your Fall Home Maintenance Checklist:

-

Clean gutters & downspouts

-

Check roof for missing/damaged shingles

-

Seal windows & doors (goodbye, drafts!)

-

Service your heating system

-

Flush your water heater

-

Check smoke & carbon monoxide detectors

-

Trim trees & shrubs away from the house

-

Drain & store outdoor hoses

-

Inspect attic & crawl spaces for pests or moisture

-

Touch up exterior paint or caulking

Edit: This Giveaway is now Closed! Stay tuned for more in the coming months.

And, to make things even easier...

🎁 We're giving away a FREE professional home inspection! 🎁

One lucky homeowner will get expert eyes on their property so they know exactly what needs attention — no guesswork, just smart prep for the future.

Enter by filling out the form linked below.

We'll draw a winner October 13th!

This is a great way to get ahead on maintenance AND be extra ready for a future sale — whether that’s next year or five years from now.

We’re always here to help you protect your investment and plan your next move, whenever you're ready. 🍁🏡

Prefer to call or text your entry?

Reach us at SK:206-200-0222 or CH:425-417-6892.

Just send your name and email and let us know you'd like to be entered!

Terms & Conditions:

- Open to legal residents of Washington State who are 18 years of age or older at the time of entry.

- Limit one (1) entry per person for the duration of the giveaway.

- No purchase necessary to enter or win.

- Entries must be submitted via online form, social media comment, email, or phone.

- All entries must be received by October 13th.

- Duplicate entries will be disqualified.

- One (1) winner will receive a free home inspection for a residential property located within King, Snohomish, and Pierce Counties.

- Prize is non-transferable and cannot be redeemed for cash.

- Winner will be notified via email, phone, and/or social media DM.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link